How To Calculate Total Loan

If you have a $5,000 loan balance, your first month of interest would be $25. Minus the interest you just calculated from the amount you repaid.

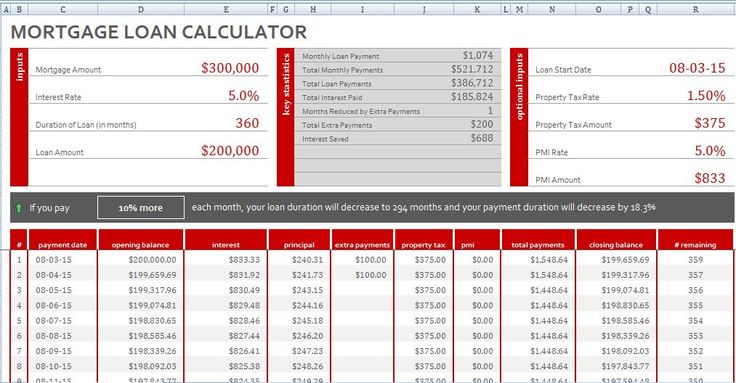

How to Create a Mortgage Calculator With Microsoft Excel

Divide the total loan by 100;

How to calculate total loan. Lenders use this ltv ratio to calculate their risk in lending money to borrowers. If you wish to calculate your interest cost for an amortizing loan, then you can use the following method: The number of equated monthly installments is equal to the number of months in the loan repayment tenure.

* minimum monthly payment is based on an intial balance of $25,000, a monthly interest rate of 0.57% (6.8%/12 months) and a payment term of 120 months. The easiest way to calculate total interest paid on a car loan is by using an online amortization calculator. Using the minimum payment, you'll pay:

0.06 (6% expressed as 0.06) n: Select the cell you will place the calculated result in, type the formula =cumipmt (b2/12,b3*12,b1,b4,b5,1), and press the enter key. To work out ongoing interest payments, the easiest way is.

Either way, you get $500. Take this amount away from the original principal to find the new balance of your loan. Multiply that number by your remaining loan balance to find out how much you’ll pay in interest that month.

Total amount to be repaid (with interest): You can now calculate the apr using the method explained above. Total of 360 payments $364,813.42:

12 (based on monthly payments) calculation 1: 1) the rate (r) would be 8 divided by 1,200 which equals.0066666666. Using the maximum payment, you'll pay:

B3 is the years of the loan, b3*12 will get the total number of periods (months) during the loan; 100,000, the amount of the loan. This loan will really cost you $0.00.

Interest rate/ number of payments x loan principal = interest number of payments: Knowing these calculations can also help you decide which kind of loan to look for based on the monthly payment. Enter the interest rate charged on your loan amount.

Enter the amount of emi that you can pay every month, the interest rate charged by your bank and the preferred tenure, the loan amount calculator will tell you how much you can afford to borrow. The apr is the annual percentage rate, and it’s the total cost of borrowing over the course of one year including all interest and additional fees. If we borrow $100,000 for 10 years at 8 per cent annual percentage rate, what is the total cost of the loan (principal plus interest) ?

All payments and fees $366,313.42 2) the number of payments (n) would be Multiply the result by the fixed fee for every $100.

Total interest to be repaid: The result is the loan’s total finance charge. Total interest on your loan:

The loan amount plus the accrued interest is divided equally over a period which is the loan tenure and you can easily calculate this final amount using an emi calculator. In the formula, b2 is the annual loan interest rate, b2/12 will get the monthly rate; Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans, or click the links for more detail on each.

Read more about factors that influence the amount you can borrow. Your estimated monthly payment is $ 287.70 *. This gives you the amount that you have paid off the loan principal.

You want to calculate monthly payments, not annual payments, so you'll need the total number of months throughout the life of the loan. Use the above formula to determine the total amount you will pay for a loan. For example, if the loan is for four years, then the.

($ 31.78 average per month) in total interest. Input the principal amount of the loan, the period of the loan in months or. No matter what type of loan you choose, always review the apr.

The higher their ltv, the riskier making a loan will be. Note, the total interest saved is reported on the payment schedule. Proceed to enter the loan term (duration) pay back period which usually, but not always coincides with the compounding period.

Create a Mortgage Calculator With Microsoft Excel

How to Calculate Annual Percentage Rate (APR) in 2020

Mortgage Payment Calculator This calculator will compute a

Do you know how much total interest you will pay on your

How to Calculate Interest Payments Box plots, Excel

How much will your mortgage cost you overall

Calculate Interest Payments Finance, Calculator

Auto Loan Calculator with Trade Fresh Car Depreciation

The mortgage loan calculator template will prove helpful

Total Interest Percentage The borrowers, Loan amount

Mortgage Calculator Home mortgage calculator DOWNLOAD at

Mortgage Calculator Calculate mortgage payment tables

How Rising Interest Rates Impact Total Payments

Personal Loan Calculator Personal loans, Loan calculator

Education Loan Calculator by Bajaj Finserv in 2020

Tiny, powerful, free loan calculator that will calculate

Interest Only Mortgage Acceleration Calculator

Create a Mortgage Calculator With Microsoft Excel

Use Our Free Credit Card Payoff Calculator